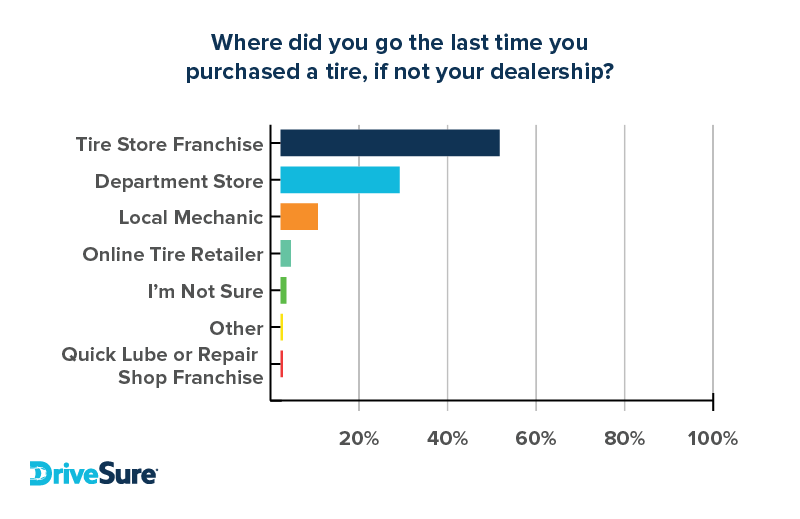

As part of the 2023 Dealership Service Retention Report, we surveyed dealership customers to figure out why they return for service and why they don’t. Among other topics, we asked respondents where they went the last time they purchased a tire, if not their dealership, and the result was concerning.

In short, we found that certain big players are becoming much more of a threat to dealership service revenue than they were in the past.

Big-box retailers like Costco and Sam’s Club are becoming increasingly popular choices for tire purchases, and dealerships need to pay attention. According to our latest Retention Report, 29% of customers who didn’t buy their tires from dealerships opted for these retail giants. That’s a significant 9% increase from our 2020 report. Most of this growth has come at the expense of traditional tire store franchises, which still hold the majority share at 52%.

What’s driving this shift? Big-box retailers offer a combination of low prices and high convenience, making them attractive options for consumers. They often provide bulk purchase discounts and have extensive inventories, allowing customers to find exactly what they need without waiting for special orders. This is coupled with another big issue, which is customer awareness of dealership tire services.

Since big-box stores are gaining more of the market, dealerships need to make sure they have a strategy for competing against them.

What keeps customers coming back to your dealership?

Insights from Nearly 1,500 Dealership Customers

Why dealerships need to prioritize tires

Even “extremely loyal” customers often don’t know that their dealerships sell tires, with less than half having made their last tire purchase there. The moment a customer goes to another service shop for tire issues, that competitor gains a golden opportunity to win over the customer through superior service, competitive pricing, or effective marketing.

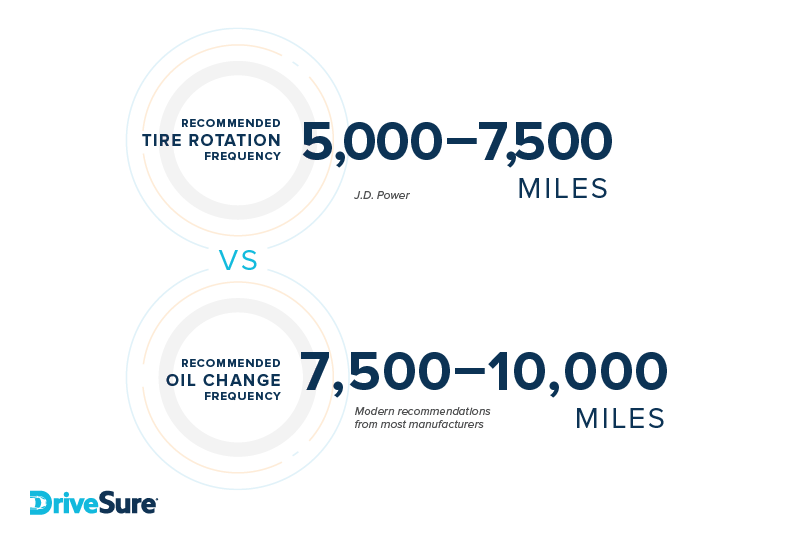

Dealerships can no longer rely solely on traditional revenue streams like oil changes. With the rise of electric vehicles and longer service intervals for internal combustion engines, those regular oil change visits are becoming less frequent. Since service intervals are extending and traditional revenue streams are diminishing, focusing on tires can be a game-changer for dealerships.

Failing to compete effectively in the tire market not only means missing out on potential revenue but also risks eroding your existing customer base.

The shift in customer preferences

When it comes to routine maintenance like tire rotations and repairs, our data shows that 63% of customers would prefer to have these services done at the dealership. While this might seem like a decent percentage, it pales in comparison to the 72% who prefer dealerships for oil changes and the 85% for manufacturer-recommended maintenance.

This gap indicates that dealerships are not yet the go-to places for tire services, despite being vastly preferred for other types of maintenance.

The opportunity here is clear: By becoming the top choice for tire services, dealerships can encourage more frequent customer visits. Each of these visits is not just a revenue opportunity but also a chance to enhance customer loyalty by addressing minor issues and providing an exceptional service experience.

So how can dealerships provide an exceptional experience? Aside from the standard suggestions like improving service quality, we’ve found that offering value-added services makes a big difference in customer satisfaction.

Standing out: Costco’s road hazard protection

Costco has been making significant strides in the tire retail market, and one of their standout services is the complimentary road hazard tire protection.

This is not just a minor perk; it’s a strategic move that aligns with the value-added service model that we’ve been recommending to dealerships for some time now. When a customer purchases a set of tires from Costco, they receive this protection at no extra cost, covering tire repairs or replacements due to road hazards like potholes or nails.

This offering does two things. First, it’s enticing for customers, making the purchase more appealing. Second, it creates a long-term relationship between the customer and Costco. Every time the customer thinks about tire-related issues, Costco is likely to be top-of-mind because they’ve already provided a service that goes beyond the initial purchase.

How value-added services help dealerships

Value-added services are becoming ever more important for retaining customers. Our Retention Report shows that these services are important to vehicle owners and can significantly influence their choice of where to purchase and service their tires. This in turn makes them twice as likely to purchase their next new vehicle there too.

Customer retention

Offering services that go beyond the basic requirements can turn a one-time customer into a repeat customer. The more you’re able to offer memorable services to the customer, the more reasons they have to return to your dealership for future needs.

Value-added services can also contribute to building brand loyalty. When customers know they can get extra benefits from your dealership, they are less likely to shop around and more likely to recommend your services to others.

Simple implementation

Value-added services like road hazard tire protection are easier to implement compared to more demanding offers, such as offering free tires for life or free powertrain warranty. This makes it feasible for dealerships to quickly adapt and offer something valuable without putting an administrative burden on staff.

Competitive edge

While brands like Costco are offering services like road hazard tire protection, dealerships starting now will still be relatively early to the show. Dealerships can stay competitive by offering unique, high-value services that most competitors aren’t matching. This could be anything from tire protection to providing streamlined (and dealer-loyal) roadside assistance.

Revenue Opportunities

Every visit for a value-added service is an opportunity for additional revenue. For example, while a customer is in for a free tire repair, service advisors can identify and address other minor issues, completing more services to catch small problems before they become big problems, and improving customer satisfaction in the process.

Find out how to keep your service customers coming back

Struggling to keep your customers loyal while competitors lure them away? Or perhaps you’re just looking to get a more comfortable lead over rival service providers? Download the 2023 Dealership Service Retention Report and see why customers leave, why they stay, and more actionable solutions to keep them around.

What keeps customers coming back to your dealership?

Download the 2023 Dealership Service Retention Report to see what dealership service customers have to say.