This article was originally posted to DrivingSales.com

Back in April, which seems like a lifetime ago in 2020 time, new car dealerships faced great uncertainty as COVID-19 tightened its grip and spread across the country.

In an effort to give dealership general managers and service directors an opportunity to stay informed about changes in demand for service departments, DriveSure has shared regular updates on closed repair order volume for dealership service departments throughout the United States.

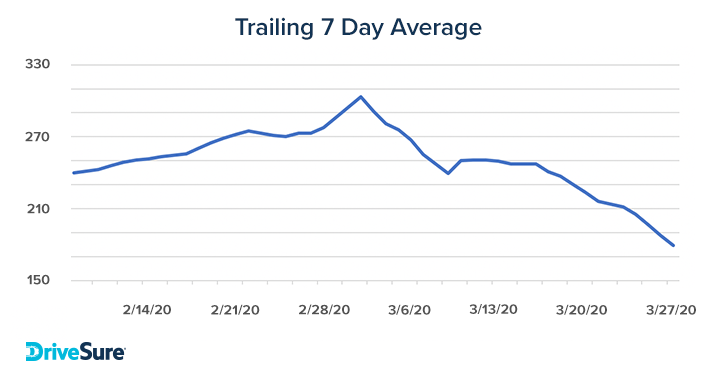

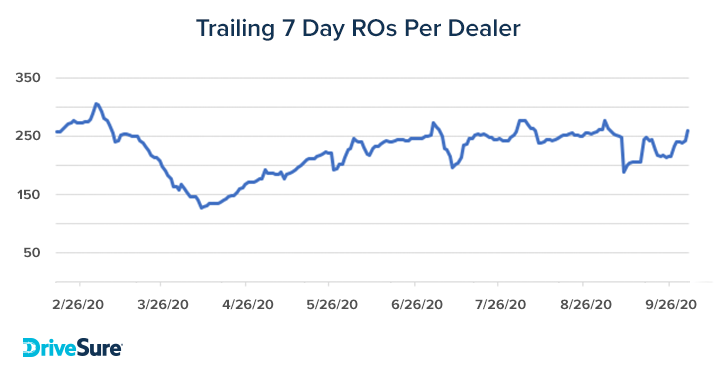

As you might imagine, rapid changes in the market this past spring resulted in steep declines in closed repair orders. From late February through April, there was a staggering 40% drop. Reaching its low point in early April—with a 7 day moving average of just 132 weekly closed repair orders per dealership—the outlook was uncertain at best.

Then things began to turn around…

Repair Order Volume Begins to Rebound

In general, repair order volume is now back to where it was pre-pandemic. In fact, by the beginning of July 2020, though COVID was still impacting much of the country, daily repair orders were beginning to rise swiftly and significantly. Since then, and now through early fall 2020, orders per dealer have remained steady and stable.

Note that because this is a trailing 7 day metric, it can show significant volatility due to holidays, such as the dip seen on September 7 due to the Labor Day holiday.

Dealership Repair Orders in “The New Normal”

The easing of restrictions and lockdowns on local, state, and national levels is clearly the main impetus for dealership services increasing and normalizing over the past several months. Beyond the obvious, though, daily routines in what’s now the “new normal” are also a factor.

Some dealerships are seeing increases in service business due to certain customer segments that are working from home and have more flexibility to bring their vehicles in for service. The data also shows significant regional variations in repair order volume based upon local and state mandates responding to the severity of COVID in their areas.

Other Factors Impacting the Numbers

In certain regions, acts of nature have also taken a toll on repair orders. So while the overall trends are promising, and by and large back to pre-pandemic levels, some areas are still struggling in what’s been an incredibly turbulent year.

The local impacts on repair order volume from wildfires in the western U.S. and some disruption along the Gulf Coast from the recent hurricane that struck there have certainly been noticeable.

Increased Reliance on Service Revenue

According to recent reports from the Congressional Budget Office (CBO), we can expect the economic effects of the pandemic to continue for the next three years, with wholesale vehicle values not returning to at least the pre-COVID-19 baseline until 2023.

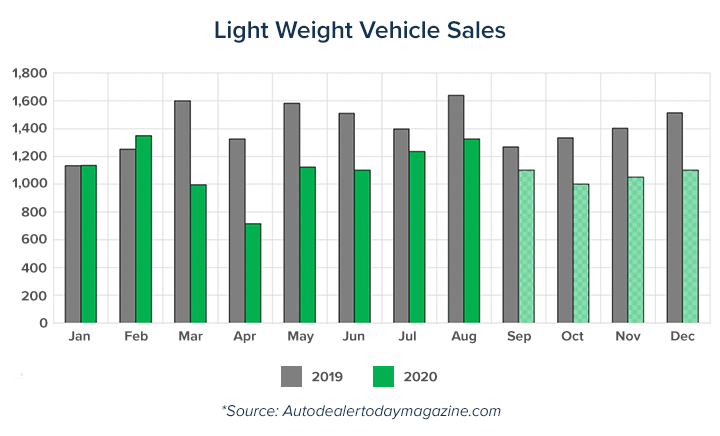

With people driving less due to remote work, high unemployment, and overall economic uncertainty, there will be a significant reduction in U.S. new vehicle sales for 2020.

With vehicle sales still down compared to 2019 year-to-date results, the importance of dealership service revenue has never been greater.

The bottom line is this: dealerships will be relying heavily on service revenue as vehicle sales sharply decline, and the continued reporting on dealer repair order volumes will give decision makers an opportunity to stay ahead of changes to service demand as much as they can and come out strong on the other side.

Dealership Service Retention is More Important Than Ever

“More than ever,” or “more important than ever.” We’ve heard those phrases a lot these past few months, and here in the case of dealership service retention, it really is true. As we just pointed out, new vehicle sales are in a major slump, and it may take some time for things to bounce back. Getting customers to return to dealerships for service is critical to success—both for maximizing fixed ops profits, and for generating new car sales.

Ensuring your customers remain loyal and return to you time and again for service has always been the best way to grow your dealership’s profits. Today, and for the foreseeable future, retaining service department customers will be vital in making up for lost revenue.

The good news, as you’ve read here, is that dealership repair order volume numbers have bounced back after a rough few months. Now it’s time to keep your momentum going and focus on delighting and retaining your customers through the last part of 2020 and beyond.

To find out what keeps your customers returning to your service center, as well as what might drive them elsewhere for service, check out the 2020 Dealership Retention Service Retention Report.

About the Data

The dealer repair order volume graphs in this article show the aggregated 7-day moving average of the weekly average number of closed repair orders per dealership for nearly 100 of our new-car dealership customers across the country, as reported through their Dealer Management System. Displaying a 7-day moving average removes effects caused by different days of the week (for example, Sundays generally have much lower volume). Data was updated daily through September, 2020, and is delayed by one week to ensure accurate reporting.

The 2020 Dealership Service Retention Report

INSIGHTS FROM NEARLY 2,000 DEALERSHIP CUSTOMERS

Learn why customers choose to return to their dealership for service and why they don’t. Plus, we reveal your biggest opportunities for encouraging customer loyalty.